Economy & Equity

Montek Singh Ahluwalia on liberalisation and welfare @Kunal Kamra Teaser https://www.youtube.com/watch?v=U5VhMr46JSU Montek Singh saying that IMF/World Bank did not insist that India cuts Welfare. Apparently the condition was that India should raise it by Taxes or cutting other expenditure. Sep 16, 2022 the full episode behind the paywall: https://bit.ly/BiTEp2

Sado-Monetarism The Role of the Federal Reserve System in Keeping Wages Low https://monthlyreview.org/2012/04/01/sado-monetarism/

by Michael Perelman Neoclassical economists are concerned about the workers’ transactions with capital, but they care little about the workers themselves or their working conditions. Workers merely accept a wage bargain, go to work, and finally collect a wage.

The Federal Reserve serves the needs of the powerful. Its role is to protect capital against the interests of labor. In order to maintain labor discipline, the Federal Reserve Board is entrusted with the task of maintaining a level of unemployment high enough to keep workers fearful of losing their jobs. Workers’ acceptance of mediocre jobs at modest wages paid handsome dividends for business, creating more demand (through debt), while making workers even more fearful of losing their jobs. In addition, workers’ insecurity also meant that they were less likely to quit in search of better employment, allowing employers to avoid the costs of recruiting and retraining replacement workers. Perhaps best of all, employers could enjoy this bounty without having to call upon the Federal Reserve to slow down the economy.

https://www.levyinstitute.org/pubs/wp_511.pdf The Fed’s Real Reaction Function Monetary Policy, Inflation, Unemployment, Inequality—and Presidential Politics* by James K. Galbraith Olivier Giovannoni Ann J. Russo August 2007 Does monetary policy influence inequality? More specifically, does information contained in the term structure of interest rates extend beyond inflation and unemployment to a measure of inequality in earnings? The answer is that it does.

Agnipath Is A Marketing Trick In Which Job Destruction Is Being Sold As Job Creation https://thewire.in/government/agnipath-scheme-job-destruction-creation-modi-government Even though the larger economic motives and social imperatives behind the Agnipath project have not been understood in its entirety by the larger public, the impact of the scheme which bars candidates above 21 years and renders 75% of recruits jobless after four years without pension benefits has triggered the anger of those who were desperately waiting for the call for recruitment.

The Agnipath shock comes months after the Railway Recruitment Board changed its eligibility qualification, leaving lakhs of aspirants high and dry. With the agricultural and unorganised sectors, which provide employment to the stay-behinds, heavily hit by demonetisation, goods and services tax and later COVID-19 and Modi’s lockdowns, north Indian youth pinned all their hopes on army recruitment. But Agnipath has come as a bolt from the blue.

India is facing a great unemployment crisis and Modi has aggravated the problem with his disastrous economic policies and now his neoliberal recruitment policies.

Comment by S Dutta: Which "India" is he talking about ? Somewhere in Latin America ?

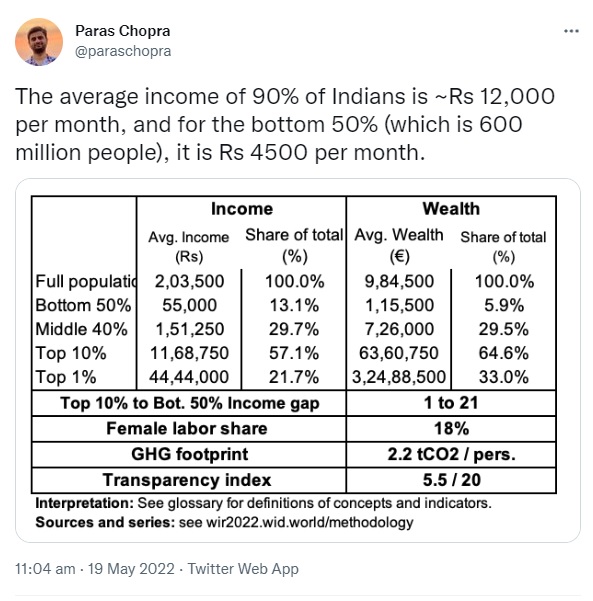

All available data shows "per capita income" of India was around 135,000--149,000 py in 2019-2020. That's also supported by outside estimates of about $1950/per capita per annum.

Did COVID push that up to INR 203,500 by some Modi magic !

And -- "Bottom 50%" of Indians are 700 million, not 600 million !

And - bottom 50% has average income of 4,500 pm means what ? Per capita or per family ? If it's per capita, as indicated, survival won't be this stressed.

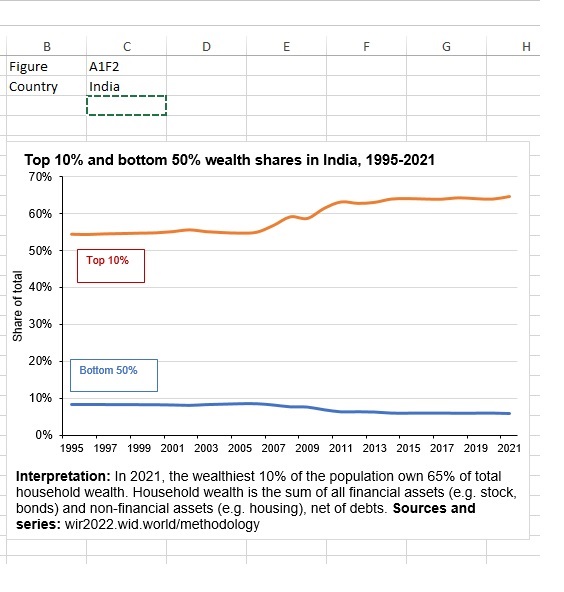

https://wid.world/country/india/

India amongst the most unequal countries in the world, says report https://economictimes.indiatimes.com/news/economy/indicators/india-amongst-the-most-unequal-countries-in-the-world-report/articleshow/88141807.cms

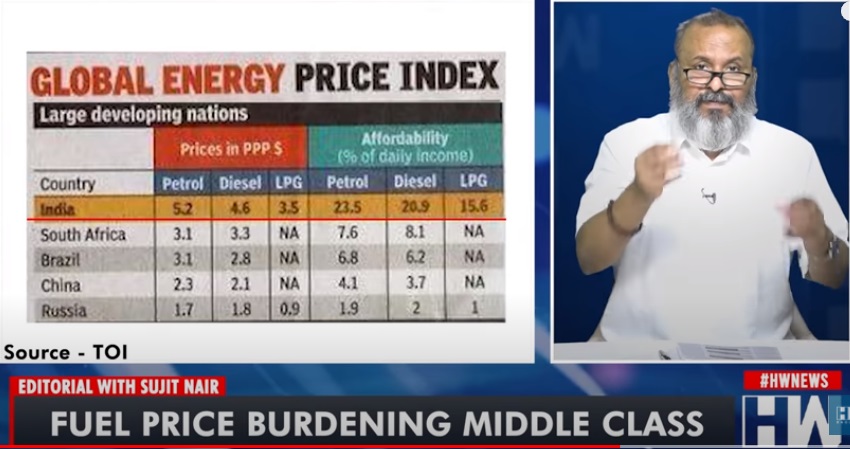

Fuel Price burdening the Middle class

https://youtu.be/uHmkBIO8eZo?start=711&end=765

when 23.5 percent and 20.9 that is almost 22 of your daily income goes into petrol and diesel and almost

15:06 of your daily wages goes into lpg

what is left for you for food !

Unfortunately the sad part is the richest man in india pays the same price for a liter of petrol as the poorest man or auto rickshaw driver pays for his diesel that both of them pay the

same price they pay the same taxes!

How fair is that?

Unviable populist schemes could create Sri Lanka-like situation, say secretaries at meet with PM Modi

https://economictimes.indiatimes.com/news/india/unviable-populist-schemes-could-create-sri-lanka-like-situation-say-secretaries-at-meet-with-pm-modi/articleshow/90633791.cms ..

Two secretaries while citing a populist scheme announced in recent assembly polls in a state, which is in financially bad shape, and similar schemes in other states said they are economically unsustainable and could take the states down the same path as Sri Lanka, the sources said.

During the meeting, Modi categorically told bureaucrats to come out of the mentality of managing shortages to the new challenge of managing surplus. He told them to give up the old story of citing "poverty" as an excuse for not taking up major development projects and asked them to adopt a bigger perspective, the sources said.

Lessons for India in Sri Lanka crisis https://www.youtube.com/watch?v=oLS6M9KuTpk Apr 6, 2022

The senior officials of India are worried that the process of distributing Revdi in elections can be dangerous. Can India go on the path of Sri Lanka? Why don't the state governments fail to make big promises despite the deficit? What is the danger in this and how can it be treated? Shivkant Sharma explained in detail in Alok Adda.

Wrong economic policies but not like Sri Lanka? https://www.youtube.com/watch?v=smQMHuHzi_M Apr 5, 2022 The economy is in dilapidated condition. Unemployment and inflation are sky high but will the country go bankrupt? Prof. Arun Kumar is answering

BJP Govt lacks economic Vision - true or false! https://www.youtube.com/watch?v=F33H6I6EsNkApr 5, 2022 Increasing debt. Rising inflation. Tremendous unemployment. Petrol diesel beyond hundred. Vegetable Oil above 200. Why is this the case? Does Modi government have a vision? Supply side vision which is banking on increasing supply side by encouraging investment/industry, but there is a problem of low demand..

- 20 Indian Companies

- India Put on Sale by the ruling regime

- What Is To Be Done to revive the Indian Economy! Franc o - Frank

- The Problem with GDP

- Economic Contraction

- Economic inequality

- Tamil Nadu Finance

- Silver Lining for the Economy

- 90% of population--have no money to spend on non-essential items

- The Economic Rights Every Indian Should Have - Prabhat Patnaik

- The Future of Inequality

- Towards Tax Justice and Wealth Redistribution in India

- Importance of Public Banking System

- Forme Secretary write to FM saying Asset monetisation counter productive

- BSNL paralysed

- Modinomics & LIC

- PSU Banks

- How to destroy the Indian Economy?

- Centre should privatise all PSBs, except State Bank of India: NCAER

- Roadshows in the US to sell IDBI Bank! Why not allow LIC to own it?

- Privatisation of PSBs Will Deal a Blow to Reservation, Government's Coffers

- RBI Director called PSU Bank Executives Scum!

- Banking Regulations: Should Corporates Own Banks?

- LIC IPO: DRHP likely this month, 20% FDI cap being proposed

- nationalize the loss making banks and privatize the profitable banks

- Legislation to Privatise Two Public Sector Banks?

- Defend Bank Nationalisation

- BMC scraps 1.8k vacant posts, hundreds of contract staff hit

- Medha Patkar on Current Economic Policy

- The Shadow Government Plundering the Public Purse

- And how common citizens are paying the price for bad Monopolies

- Employees of Mahavitaran Jalgaon zone against privatization.

- Issues with Privatisation of Essential Services and Free Speech Institutions

- SC Dismisses Kerala Govt's Plea Against Adani Group's Takeover of Thiruvananthapuram Airport

- Understanding Deregulation, Privatisation & Economic Reforms

- Pawan Hans Sale: Cayman Firm in Winning Bid Flayed By NCLT

- the biggest privatisation scam in India

- Welcome Kerala Legislative Assembly’s resolution opposing disinvestment of the LIC

- Where has all the silver gone?

- LIC IPO- Gross injustice to the smaller LIC policy holders, especially those belonging to the SCs/STs/OBCs

- How to kill LIC -story behind IPO

- The political economy of CPSE disinvestmen

- Companies Bought & Sold by different Prime Ministers

- Public Private Partnerships – Subsidy and Impunity for Private Corporations

- CEL Sale

- On Trend for Privatisation: Kanhaiya Kumar

- Privatisation of CEL

- Privatisation: What Does It Really Mean?

- Dayanidhi Maran Shows Mirror To Govt On NPA Write-off and Haircut To Corporates

- virtually extending the lease in perpetuity

- World Bank offers to help National Rail Plan B

- Privatising power distribution: A hoax

- Modi’s Monetisation Worse than Demonetisation.

- Economics of Monetisation of Assets

- Monetisation: Designed To Create 2-3 Monopolies

- Privatised Infrastructure by Adani Group

- To BEST: Why are we waiting for hours?

- Pre-Paid electricity meters to be like FASTAG!