Economy & Equity

Even when prices are subsidised, the marginalised still cannot afford the minimum required for adequate nutrition and quality education. As a result, many of these basic amenities have been provided for free, turning them into ‘labhartis’. This approach reduces poverty and offers long-term benefits for society.

https://thewire.in/rights/who-are-indias-labharthis-the-visible-and-the-veiled

Alternatively, the system must enable the marginalised to earn a ‘living wage’ as promised under the Constitution. Many workers are either underemployed, working in disguised unemployment, or have stopped looking for work altogether. As a result, workers are forced to accept low wages. Due to the shortage of suitable employment and low wages, family incomes remain inadequate for the marginalised.

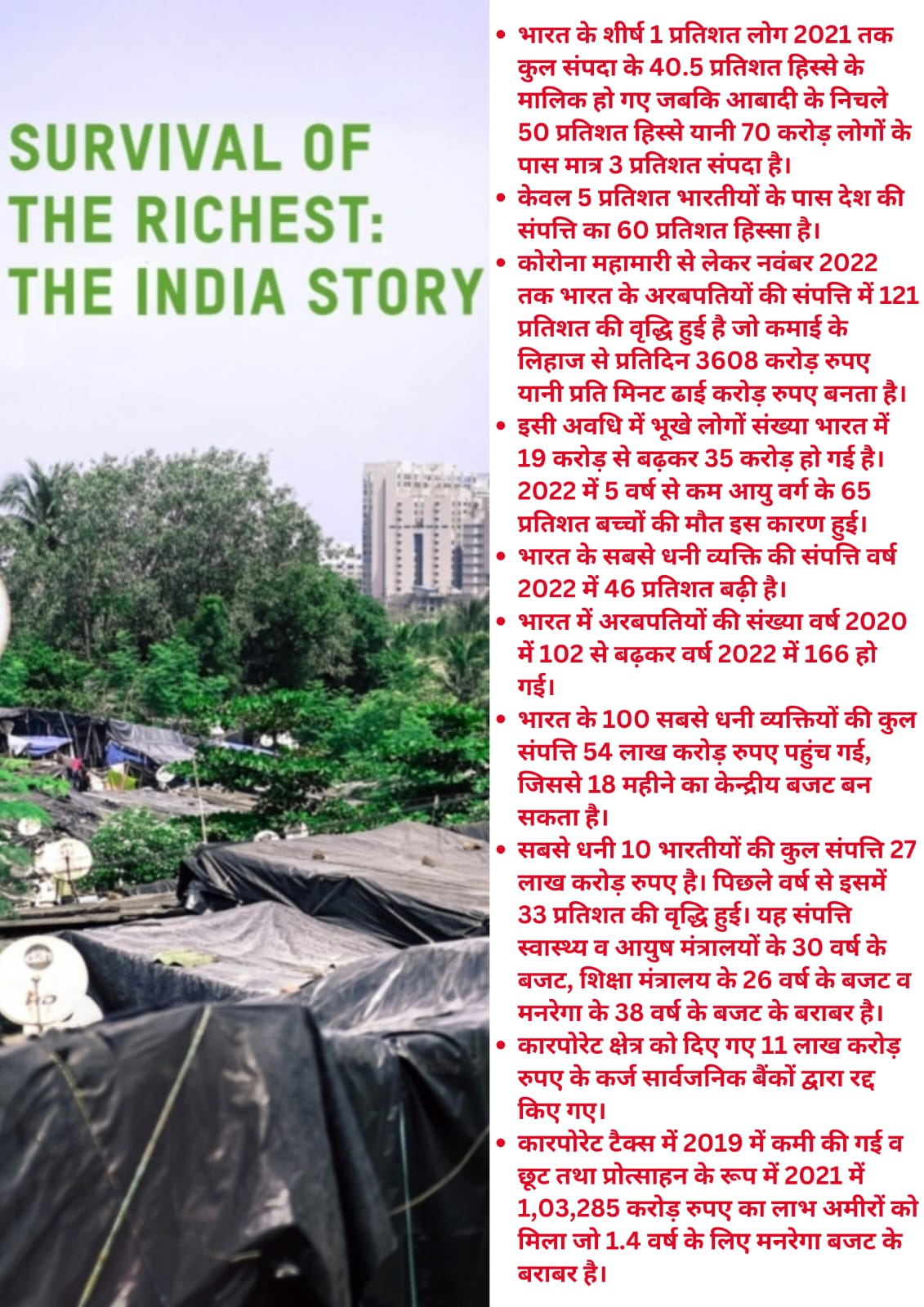

Real national income has increased by a factor of 29.76 between 1950-51 and 2022-23. Data from Credit Suisse suggests that most of this increase has accrued to the well-off and big business constituting the top 1% of the population. So, they owned 51.5% of the wealth in 2018 while the bottom 60% had only 4.7% of it. In income terms, the top 1% earned 22% while the bottom 50% earned 13%. This is the result of policies that have yielded little trickle-down effect.

The well-off have gained even more through the black economy, which is not taken into account in the official data. It was estimated at 62% of the GDP in 2012-13 and has been growing and is concentrated in the hands of the top 3% of the income earners. The ruling elite has perpetuated it through a triad of corrupt businessmen, politicians, and the executive, who share the illegal gains, thereby further marginalising the marginalised.

All this makes India one of the most unequal societies in the world

The blame for the adoption of trickle-down policies falls squarely on the ruling elite, consisting of business interests, the urban elite, and broadly the well-off. They have been the policymakers, not the marginalised. They have been the real ‘labhartis’ of the system for the last 75 years.

They have shaped government policies and the annual budgets of the Centre and the states, enabling them to corner the nation’s resources. They present their interests as the nation’s interests, ignoring those of the marginalised. Unemployment, as mentioned above, helps keep wages low, enabling businesses to generate higher profits. The elite can afford their luxurious lifestyles because of the low wages paid to servants and chauffeurs.

This process of cornering resources was accentuated in 1991 and further in 2014 in the name of promoting growth. For instance, during the pandemic in May 2020, the ‘Atmanirbhar’ package of Rs 20 lakh crore allocated about Rs 3 lakh crore to the marginalised, while the rest went to the well-off in various forms. The marginalised suffered the most, but it was the well-off who received the majority of the support. No wonder that while the economy declined, the stock market wealth of the well-off skyrocketed.

So, behind the veil of policies for ‘national good’, the real ‘labharthi’ has been big business and the elite. How can the leadership not see this when repeatedly pointing a finger at the marginalised? Is that the motivation for an authoritarian rule?

by Arun Kumar

29/05/2024

Despite media exposés and frequent public complaints, banks nationwide continue taking money without authorisation from accounts to enrol customers in low-cost life-insurance and accident-insurance schemes launched by Prime Minister Narendra Modi. To meet targets set by the union government, bank offices are now withdrawing money from accounts of many customers en masse, in some cases even forging customer consent and asking local offices to camouflage forgeries.

Time to tax the rich

Greater taxation of rich people is not the only answer to the inequality crisis, but it is a fundamental part of it.

It is time for governments to shake off decades of failed ideology and rich elite influence, and to do the right

thing: tax the rich.

The revenues raised from this new wave of progressive taxes could then be used to build a fairer, more equal

and sustainable future for us all.

Governments must use the tax tools at their disposal to turn back this tide of inequality, following these four

steps to a more equal world:

1. Introduce one-off solidarity wealth taxes and corporate windfall taxes as well as much higher taxes on

dividend payouts to stop crisis profiteering.

2. Permanently increase taxes on the richest 1%, for example to a minimum of 60% of their income from both

labour and capital, with higher rates for multi-millionaires and billionaires.

3. Tax the wealth of the super-rich at rates high enough to systematically reduce extreme wealth and lower

power concentration and inequality.

4. Use the revenues from these taxes to increase government spending on inequality-busting sectors, such as

healthcare, education and food security, and to fund the just transition to a low-carbon world.

Aqal Ki Baat : Nikhil Dey- State of Various Schemes in India https://www.youtube.com/watch?v=RJKfbgfHccY Anhad India Apr 19, 2019

Aqal Ki Baat is a voluntary effort by a small group of friends to sensitize the citizens on various issues of concern. In times when national media has totally compromised and lies are propagated and repeated a 100 times, when all efforts are made to ensure that people do not question and do not think, Aqal Ki Baat is a small effort to question the one sided narrative. Please do watch, hear and share with friends.

Vote to defeat forces of hatred and violence. Safeguard democracy.

- Montek Singh Ahluwalia on liberalisation and welfare

- Sado-Monetarism

- World Inequality Report

- Fuel Price burdening the Middle class

- Unviable populist schemes could create Sri Lanka-like situation

- 20 Indian Companies

- India Put on Sale by the ruling regime

- What Is To Be Done to revive the Indian Economy! Franc o - Frank

- The Problem with GDP

- Economic Contraction

- Economic inequality

- Tamil Nadu Finance

- Silver Lining for the Economy

- 90% of population--have no money to spend on non-essential items

- The Economic Rights Every Indian Should Have - Prabhat Patnaik

- The Future of Inequality

- Towards Tax Justice and Wealth Redistribution in India

- Importance of Public Banking System

- Forme Secretary write to FM saying Asset monetisation counter productive

- BSNL paralysed

- Modinomics & LIC

- PSU Banks

- How to destroy the Indian Economy?

- Centre should privatise all PSBs, except State Bank of India: NCAER

- Roadshows in the US to sell IDBI Bank! Why not allow LIC to own it?

- Privatisation of PSBs Will Deal a Blow to Reservation, Government's Coffers

- RBI Director called PSU Bank Executives Scum!

- Banking Regulations: Should Corporates Own Banks?

- LIC IPO: DRHP likely this month, 20% FDI cap being proposed

- nationalize the loss making banks and privatize the profitable banks

- Legislation to Privatise Two Public Sector Banks?

- Defend Bank Nationalisation

- BMC scraps 1.8k vacant posts, hundreds of contract staff hit

- Medha Patkar on Current Economic Policy

- The Shadow Government Plundering the Public Purse

- And how common citizens are paying the price for bad Monopolies

- Employees of Mahavitaran Jalgaon zone against privatization.

- Issues with Privatisation of Essential Services and Free Speech Institutions

- SC Dismisses Kerala Govt's Plea Against Adani Group's Takeover of Thiruvananthapuram Airport

- Understanding Deregulation, Privatisation & Economic Reforms

- Pawan Hans Sale: Cayman Firm in Winning Bid Flayed By NCLT

- the biggest privatisation scam in India

- Welcome Kerala Legislative Assembly’s resolution opposing disinvestment of the LIC

- Where has all the silver gone?

- LIC IPO- Gross injustice to the smaller LIC policy holders, especially those belonging to the SCs/STs/OBCs

- How to kill LIC -story behind IPO

- The political economy of CPSE disinvestmen

- Companies Bought & Sold by different Prime Ministers

- Public Private Partnerships – Subsidy and Impunity for Private Corporations

- CEL Sale

- On Trend for Privatisation: Kanhaiya Kumar

- Privatisation of CEL

- Privatisation: What Does It Really Mean?

- Dayanidhi Maran Shows Mirror To Govt On NPA Write-off and Haircut To Corporates

- virtually extending the lease in perpetuity

- World Bank offers to help National Rail Plan B

- Privatising power distribution: A hoax

- Modi’s Monetisation Worse than Demonetisation.

- Economics of Monetisation of Assets

- Monetisation: Designed To Create 2-3 Monopolies

- Privatised Infrastructure by Adani Group

- To BEST: Why are we waiting for hours?

- Pre-Paid electricity meters to be like FASTAG!

https://oi-files-d8-prod.s3.eu-west-2.amazonaws.com/s3fs-public/2023-01/Survival%20of%20the%20richest-Full%20Report.pdf

https://oi-files-d8-prod.s3.eu-west-2.amazonaws.com/s3fs-public/2023-01/Survival%20of%20the%20richest-Full%20Report.pdf