Adanigiri

भारत सरकार के Pegasus से अडानी के लिए जासूसी की गई ?Adani की जांच कर रहे लोगों के मोबाइल में spyware https://www.youtube.com/watch?v=yDBo-TEGIC4

GIRIJESH VASHISTHA Nov 9, 2023 the use of the 'Pegasus' spyware by the Indian government to surveil the phones of Indian journalists. We will explore whether the Indian government employed Pegasus to hack into the phones of journalists following an OCRP report on Adani's wealth and whether the Modi government is monitoring journalists due to their reporting on Adani.

indian journalist targetted with NSO spyware https://www.reuters.com/world/india/indian-journalist-targeted-with-nso-spyware-anti-corruption-group-says-2023-11-07/ The journalist, Anand Mangnale, was among a series of people in India who received alerts from Apple (AAPL.O) last week warning them that they had been targeted by "state-sponsored" hackers trying to remotely access their iPhones. Apple's alerts did not identify the government behind the hacks or the spyware used.. OCCRP's co-founder Drew Sullivan told Reuters said an internal forensic investigation tied the intrusion effort against Mangnale's phone to Israeli firm NSO's Pegasus hacking tool. The spyware allows hackers sweeping access to the targets' smartphones, allowing them to record calls, intercept messages and transform the phones into portable listening devices.

Indian Journalists Targeted with State Intimidation and Spyware https://www.occrp.org/en/announcements/40-presss-releases/18198-indian-journalists-targeted-with-state-intimidation-and-spyware 08 November 2023 OCCRP Since OCCRP published an investigation in August that uncovered potentially controversial shareholders in India’s third-largest conglomerate, reporters who worked on the story have been targeted with state intimidation and surveillance attempts.

the investigation showed how two men who secretly invested in the Adani Group turned out to have close ties to its majority owners, the Adani family, raising questions about violations of Indian law. The Adani Group denies the allegations. Last month, OCCRP partner journalists Ravi Nair and Anand Mangnale were summoned by the crime branch of the Ahmedabad police in Modi’s home state of Gujarat to appear in person for questioning in a preliminary probe based on a complaint by a man identified only as “an investor” who claimed the investigation was “grossly malicious.” It is unclear why this is a police matter.

Mangnale’s phone has also been targeted with sophisticated spyware. According to iVerify, a Pegasus attack occurred within hours of sending out pre-publication questions to the Adani Group in August. There is no evidence the Adani Group had any role in the use of the surveillance tool.

The forensic analysis does not indicate which agency or government is behind the attack. (Pegasus is only licensed to governments.)

5 new reports on Adani Group. 5 new reports on Adani Group https://www.youtube.com/watch?v=Uzf1y74fR3o

Financial Times is the same newspaper about which Gautam Adani had said that he would like to create an institution like the Financial Times.

In fact, in the last 11 months, so much news has come about Adani Group that a separate news channel can be made for them too. Serious reports have come regarding more than a dozen different companies of Adani Group. In these reports, the correspondents have spent a lot of time, studied many documents and have also shown them in their reports. Even after this nothing happened. Every report comes like a ball and ends up hitting the wall. Three lines were published on News Click in New York Times, its office and that of more than 40 journalists associated with it were raided. The police interrogated and seized the phone and laptop. All the news related to Adani Group has been published in not one but many foreign and Indian newspapers but the investigating agencies did not have the courage to go to his office. In India, even minor allegations of corruption get investigated, this is one case on which continuous reporting has been going on for the last eleven months, opposition parties are raising their voice but there is no result.

Overpricing of Coal Imports By Adani Group Led to Higher Profits, Customers Overcharged for Fuel: FT https://www.ft.com/content/7aadb3d7-4a03-44ba-a01e-8ddd8bce29ed

Overpricing of Coal Imports By Adani Group Led to Higher Profits, Customers Overcharged for Fuel: FT https://www.ft.com/content/7aadb3d7-4a03-44ba-a01e-8ddd8bce29ed

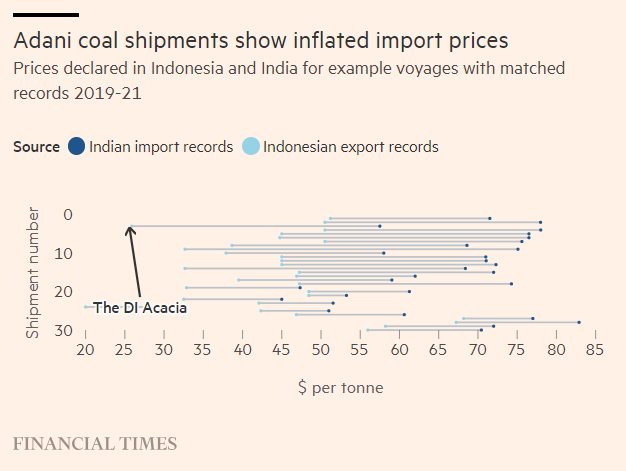

https://thewire.in/business/adani-coal-imports-over-pricing-customers-overcharged-fuel-ft A detailed FT investigation points to Adani’s use of “offshore intermediaries” to import $5 billion worth of coal at prices that were at times more than double the market price. One of these firms is owned by a Taiwanese businessman who was named by FT as a hidden shareholder in Adani firms...

in January 2019, coal meant for Adani, departed “the Indonesian port of Kaliorang in East Kalimantan carrying 74,820 tonnes of thermal coal destined for the fires of an Indian power station. While “in export records the price was $1.9mn, plus $42,000 for shipping and insurance. On arrival at India’s largest commercial port, Mundra in Gujarat run by Adani, the declared import value was $4.3mn.”

For 42 million tonnes of coal supplied by its own operations (in FY ending March 2023), the Adani group declared an average price of $130 per tonne. But for the 31 million tonnes of coal supplied by its three middlemen ( of doubtful ownership) , the average price declared per tonne was $155, per tonne. This was at a “20% premium worth almost $800 million.”

" these high costs translated directly into higher prices paid by consumers, especially in Gujarat where the opposition Congress party has already flagged the issue. In August this year, opposition politicians in Gujarat accused the state government of making almost $500 million in excess payments to Adani Power over five years under a power purchase agreement linked to the price of coal. “GUVNL paid Rs 13,802 crore ($2 billion) as energy charges to the company. But if coal rates as per Argus index is taken into consideration, then only Rs 9,902 crore ($1.5 billion) should have been paid,”

मनमोहन ने बनाई थी हज़ारों करोड़ फर्जीवाड़े की CD फिर आ गए मोदी । Navin Kumar https://www.youtube.com/watch?v=LgcqTQ8Bx98 1st Sept 2023.

Adani Group Rejects "Recycled Allegations" In OCCRP Report https://www.ndtv.com/india-news/adani-group-rejects-allegations-of-hidden-foreign-investors-by-george-soros-funded-occrp-calls-them-recycled-allegations-4344117 August 31, 2023 "We categorically reject these recycled allegations. These news reports appear to be yet another concerted bid by Soros-funded interests supported by a section of the foreign media to revive the meritless Hindenburg report. In fact, this was anticipated, as was reported by the media last week," said the ports-to-power conglomerate in a statement.

The claims, the conglomerate said, were based on closed cases from a decade ago when the Directorate of Revenue Intelligence (DRI) probed allegations of over-invoicing, transfer of funds abroad, related party transactions and investments through FPIs (Foreign Portfolio Investors). "An independent adjudicating authority and an appellate tribunal had both confirmed that there was no over-valuation and that the transactions were in accordance with applicable law. "Notably, these FPIs are already part of the investigation by the SEBI.

https://www.occrp.org/en/investigations/documents-provide-fresh-insight-into-allegations-of-stock-manipulation-that-rocked-indias-powerful-adani-group Now, new documents obtained by reporters reveal two men who spent years trading hundreds of millions of dollars’ worth of Adani Group stock: Nasser Ali Shaban Ahli and Chang Chung-Ling. Both have close ties to the Adani family, including appearing as directors and shareholders in affiliated companies. Records show that the investment funds they used to trade in Adani Group stock received instructions from a company controlled by a senior member of the Adani family...

The essence of the allegations was that some of the Adani Group’s key “public” investors were in fact Adani insiders, a possible violation of Indian securities law. But none of the agencies contacted by the committee were able to identify those investors, since they were hidden behind secretive offshore structures.

Modi-linked Adani family secretly invested in own shares, documents suggest https://www.theguardian.com/world/2023/aug/31/modi-linked-adani-family-secretly-invested-in-own-shares-documents-suggest-india During Modi’s time as leader, the power and influence of the Adani Group has soared, with the conglomerate acquiring lucrative state contracts for ports, power plants, electricity, coalmines, highways, energy parks, slum redevelopment and airports. In some cases, laws were amended that allowed Adani Group companies to expand in sectors such as airports and coal. In turn, the stock value of the Adani Group rose from about $8bn in 2013 to $288bn by September 2022.

Adani has repeatedly denied that his longstanding connection with the prime minister has led to preferential treatment, as has the Indian government.

Hidden Adani Investors Uncovered By Hindenburg 2.0? | OCCRP Investigation | https://www.youtube.com/watch?v=ENvtDFkEZPY Akash Banerjee The Deshbhak

https://www.youtube.com/watch?v=5oQTuk0UEK8 Gautam Adani और Modi की वजह से डूबा लाखों लोगों का पैसा | Sanjay Singh ने किया EXPOSE Aam Aadmi Party

Adani partners used offshore funds to invest in its shares, alleges report https://scroll.in/latest/1055166/adani-partners-used-offshore-funds-to-invest-in-its-shares-says-report Arun Agarwal, a stock market specialist and transparency advocate, told OCCRP that it is illegal for any company to hold over 75% of its shares. “When the company buys its own shares above 75%… it’s not just illegal, but it’s share price manipulation,” Agarwal added. “This way the company [creates] artificial scarcity, and thus increases its share value – and thus its own market capitalisation.”

After Hindenburg, OCCRP strikes Adani Group: Is everything a Soros conspiracy? TV Newsance 224 https://youtu.be/C7HJZ7jeY6Y?t=733

क्या है अदाणी-OCCRP की कहानी | The Adani-OCCRP Saga https://www.youtube.com/watch?v=_Ab7As8kD8A

https://youtu.be/IolnK99GG4o?t=466 Money trail . Sep 4, 2023 , yet another expose on Adani has put names and faces into allegations of share price manipulation. The question is will the SEBI investigators act now?

- SBI-led consortium to fund Adani Group’s ₹34,000-crore PVC project in Mundra

- Supriya Srinate on Adani Issue Gist interview

- What the Adani Story reveals about Indian Democracy

- George Soros ‘game plan’ revealed, wants “Democratic revival” in India

- Adani को Supreme Court की कमिटी ने कोई क्लीन चिट नहीं दी.