Overpricing of Coal Imports By Adani Group Led to Higher Profits, Customers Overcharged for Fuel: FT https://www.ft.com/content/7aadb3d7-4a03-44ba-a01e-8ddd8bce29ed

Overpricing of Coal Imports By Adani Group Led to Higher Profits, Customers Overcharged for Fuel: FT https://www.ft.com/content/7aadb3d7-4a03-44ba-a01e-8ddd8bce29ed

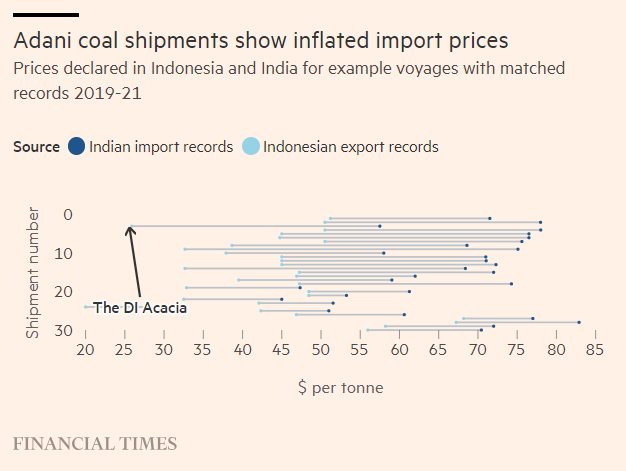

https://thewire.in/business/adani-coal-imports-over-pricing-customers-overcharged-fuel-ft A detailed FT investigation points to Adani’s use of “offshore intermediaries” to import $5 billion worth of coal at prices that were at times more than double the market price. One of these firms is owned by a Taiwanese businessman who was named by FT as a hidden shareholder in Adani firms...

in January 2019, coal meant for Adani, departed “the Indonesian port of Kaliorang in East Kalimantan carrying 74,820 tonnes of thermal coal destined for the fires of an Indian power station. While “in export records the price was $1.9mn, plus $42,000 for shipping and insurance. On arrival at India’s largest commercial port, Mundra in Gujarat run by Adani, the declared import value was $4.3mn.”

For 42 million tonnes of coal supplied by its own operations (in FY ending March 2023), the Adani group declared an average price of $130 per tonne. But for the 31 million tonnes of coal supplied by its three middlemen ( of doubtful ownership) , the average price declared per tonne was $155, per tonne. This was at a “20% premium worth almost $800 million.”

" these high costs translated directly into higher prices paid by consumers, especially in Gujarat where the opposition Congress party has already flagged the issue. In August this year, opposition politicians in Gujarat accused the state government of making almost $500 million in excess payments to Adani Power over five years under a power purchase agreement linked to the price of coal. “GUVNL paid Rs 13,802 crore ($2 billion) as energy charges to the company. But if coal rates as per Argus index is taken into consideration, then only Rs 9,902 crore ($1.5 billion) should have been paid,”