Uninvested: How Wall Street Hijacks Your Money & How to Fight Back http://www.bobbymonks.com/book/ financial firms and money managers have complicated the investing process to keep us in the dark, profiting from our ignorance

Uninvested: How Wall Street Hijacks Your Money & How to Fight Back http://www.bobbymonks.com/book/ financial firms and money managers have complicated the investing process to keep us in the dark, profiting from our ignorance

http://www.bobbymonks.com/when-you-invest-in-mutual-funds-you-give-up-your-voice/ Third-party analysts, such as Morningstar, credit- rating agencies, traditional accounting firms, and the financial media, have trained investors to consider their investments in exclusively financial terms. Mutual funds, in particular, encourage this one-dimensional perspective. Because funds and pundits are most comfortable with conventional metrics such as earnings per share, market capitalization, and quarterly returns, they emphasize these topics in their assessments. The success of an investment is nearly always measured by its return. https://www.thestreet.com/opinion/when-you-invest-in-mutual-funds-you-give-up-your-voice-13247213

Investment must be seen as an endorsement of a corporation's practices, activities, and values. Investing in a company is like voting with your dollars. Doesn't it make sense to support the companies, products, and services that you like and believe in? And to withhold your capital from corporations that you don't like or believe in?

Mainstream mutual funds make selective, values-based investing nearly impossible, given their typical blanket approach. There is, however, a small and growing subset of funds that do acknowledge issues-based investing; the number of "socially responsible investing" vehicles increased from 55 in 1995 to 493 in 2012.41 Still, these types of funds account for a relatively modest share of the market overall, and they don't resolve many other issues inherent in mutual fund investing.

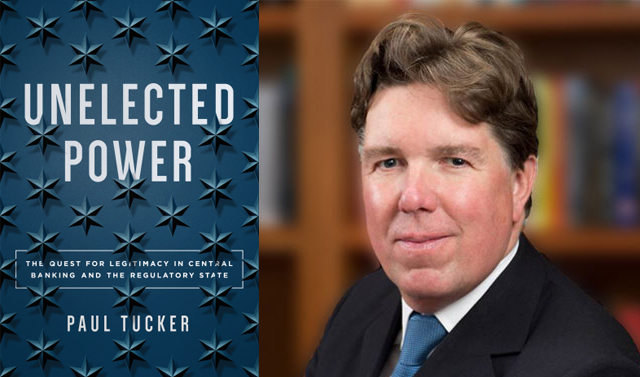

Paul Tucker – Unelected Power: The Quest for Legitimacy in Central Banking and the Regulatory State 24 Oct 2018 https://www.youtube.com/watch?v=R-Dxrs7dj0w

Digital currency and the future of central banking https://www.youtube.com/watch?v=ruYgeildvbk

Digital currency and the future of central banking https://www.youtube.com/watch?v=ruYgeildvbk

18 Nov 2021