Corporate Tilt

There is a strong case for the government – and the opposition – to recognise how the Modi government and its allied group of companies profited at the cost of the poor.

https://thewire.in/economy/india-inflationary-tax-poor-corporate-greed-price-gouging Companies, particularly in oligopolistic market conditions (markets where few firms/corporate companies control the market share of a commodity) tend to keep prices high to earn abnormal profits, especially in times of conflict, crisis or emergencies, and ‘greed’ underlines the motivation for artificially producing inflation, acting as a tax on the most vulnerable and poor.

When oil companies were making abnormal profits from volatile oil prices in Europe, one of the measures adopted by the European Union was to impose a windfall profit tax on the energy providers – to correct the abnormal rise of incomes experienced by such companies and give relief to the consumers.

In the Indian scenario though, instead of imposing any windfall profit tax on profiteering firms, the Narendra Modi government did the opposite by closely colluding with oil companies to profit from any potential gains made from cheaper oil imports (from Russia).

India’s own tryst with ‘seller’s inflation’

18/12/2023

India’s Plastic Ban: A triumph for the fossil fuel industry? By Swathi Seshadri and Ashi Datta | July 26, 2022 https://www.cenfa.org/indias-plastic-ban-a-triumph-for-the-fossil-fuel-industry/ Analysts at Kotak Institutional Equities, which has released a report on the ban, claims that the current ban will not affect FMCGs, but one on sachets/pouches/wrappers/laminated tubes could impact their profitability. ..The 2021 Rules treat SUPs generated by FMCG and non-FMCGs differentially (except for the straws attached to packaged branded beverages). While there is a ban on non-FMCG SUPs, companies in the FMCG category have been allowed to go scot-free since accountability measures like Extended Producer Responsibility (EPR) are only introduced in diluted forms allowing for use of these toxic materials by paying a small fee and staggering transition over 3 years.

According to a PlastIndia (2019) report, Reliance Industries Limited is the sole producer of LDPE (a variety of plastic raw materials used in SUPs) and owns 42% of the total production capacity of commodity plastics, used to manufacture SUPs with OPaL in a distant second place.

A February 2022 CPCB notification identifies 18 polymer producers who supply raw materials for SUPs, which is a niche industry. Since the ban is limited to only some SUPs, this will not have a significant damaging effect on these producers since they will continue producing polymers for other SUPs which have not been banned.

Banning SUPs used by big corporations would mean upsetting billion-dollar industries, a move that the Indian government has not even remotely considered yet. If the government indeed wants to put money where its mouth is, it would focus on envisioning a retail system which will take us away from the use-and-throw economy to one which is designed for reusable and sustainable packaging and which considers the interests of not big corporations but smaller players, the end user and fundamentally, the environment and climate.

Windfall tax to recoup most of Rs 1 trillion revenue lost in excise cuts https://www.business-standard.com/article/economy-policy/windfall-tax-to-recoup-most-of-rs-1-trillion-revenue-lost-in-excise-cuts-122070300199_1.html

The windfall tax on oil produced within India and fuel exported overseas will make up for more than three-fourths of the revenue lost when it cut excise duty on fuel, industry sources said.

Giving out reasons for the introduction of the new levies, Sitharaman had on Friday stated that refiners earned "phenomenal profits" from shipping overseas while reducing domestic supplies."We don't grudge people earning profits," she had said.

"But if oil is not being available (at petrol pumps) and they are being exported... exported with such phenomenal profits. We need at least some of it for our own citizens and that is why we have taken this twin-pronged approach."

सरकारी प्रेम से अडानी और अंबानी को एक और फायदा, इम्पोर्ट एक्सपोर्ट में कर दिया खेल https://www.youtube.com/watch?v=sTNr14C_ch0

4th July 2022 o भारत में अडानी और अंबनी के लिए नीतियों में बदलाव की ये खबर नयी है. किस तरह कोयले में सरकार ने सारी हदें पार करके अडानी को प्रश्रय दिया है और अंबानी की भलाई के लिए देश में बाकायदा पेट्रोल डीजल आयात करना पड़ा है यही बता रहे हैं गिरिजेश वशिष्ठ

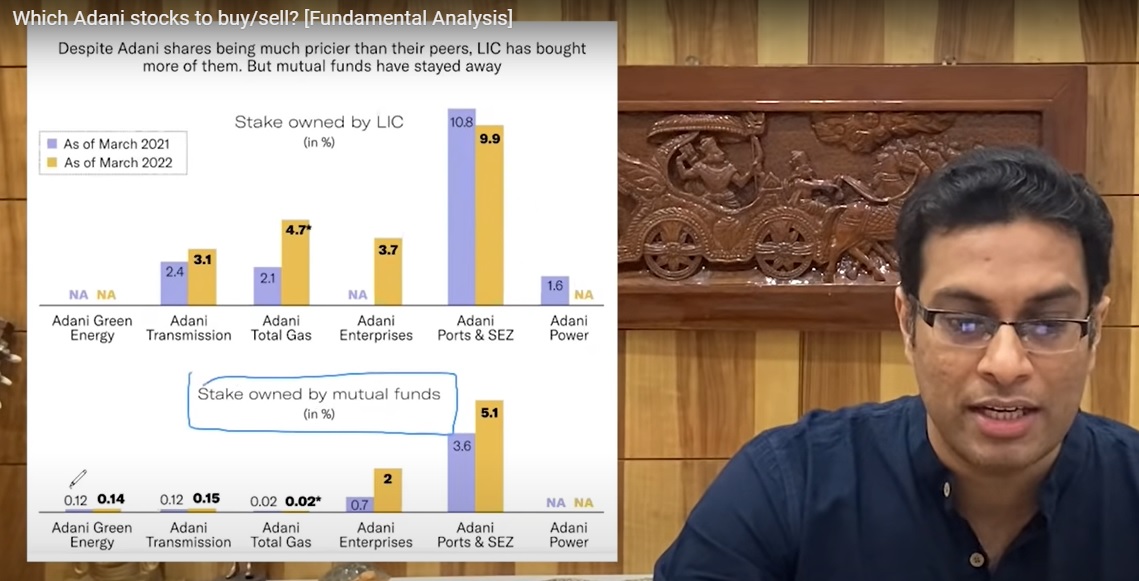

History of Adani Group, and the growth of its stock https://www.youtube.com/embed/5jX7Fvwhm3c?start=248s&end=1068s

taken from a stock analyst Akshat Shrivatava stock analysis titled "Which Adani stocks to buy/sell? [Fundamental Analysis] ". https://youtu.be/5jX7Fvwhm3c?t=849 at this point he speak of how poltical connections, and how LIC has been buying LIC stocks. elsewhere he also speaks about how he got trolled as anti-nationalist.. when he tweeted that the PE ratio of tata power compared to adani power.

- Students of O.P. Jindal Global University stand in solidarity with the villagers of Dhinkia

- Bhopal gas tragedy survivors pose 37 questions

- The Odisha Train Crash Was the Terrible Cost of Ignoring CAG Audits

- Bhopal Gas Tragedy | Who was Responsible?

- Cover Your Tracks: The Modi Government’s Attitude After the Balasore Tragedy