Human Rights Defenders Data Information Knowledge Solidarity

HRDs must counter State's offensive of intimidating ordinary people, from expressing their opinion on social media or on various issues . Lawyers as well as Journalists, and youtubers bring these cases up in the public eye in order to youth to feel more secure speaking out.. This series we will document case law as well as reports through links to documents, reports from various websites and Blogs and Posts of HRDs. This is also an attempt to publicise all the dirty tricks State have been using. This is a contributory effort..

The Supreme Court on February 1 upheld the National Green Tribunal’s order in 2020, to demolish an edible oil storage facility constructed by two companies, joint ventures of KTV Group and Adani Wilmar Limited. https://thewire.in/environment/adani-joint-venture-ktv-oil-mills-health-food

In 2016, fisherfolk in north Chennai – near Chennai Port – began questioning the impacts of a storage facility that was located close to the fishing villages of Thiruchirakuppam, Thazhankuppam and several others. They started noticing frequent oil leaks from the 7 km-long pipeline from the harbour to the storage facility set up by the K.T.V. companies, said M.R. Thiagarajan, president of the Meenava Thanthai Selvarajkumar Sangam, a local organisation that takes up fishers’ issues.

Oil would sometimes spill on to the ground; but oil leaks into the sea nearby would frequently result in fish kills – fish would die and rise to the water surface – claimed Thiagarajan.

“When that happens, fish do not venture into the area for at least three months and this results in low fish catch,” the 57-year-old fisherman told The Wire.

05/02/2023

read more

Past investigations into Adani's businesses have come to nothing - Ravi Nair https://www.youtube.com/watch?v=TQDXiOdWxpc The Leaflet Feb 5, 2023

Ravi Nair, an independent investigative journalist who has exposed many instances of corporate misconduct and has written extensively on the rise of the Adani Group in India and abroad, talks to The Leaflet on the Hindenburg Research's report. Past investigations into the Adani group by the market regulator SEBI or the intelligence agency DRI have not produced results, notes Nair. The Union Government must prove that India has a clear, strict regulatory mechanism, he says. Nair also discusses the Adani Group's response that the report is a "calculated attack on India", asking "Is Adani India or equal to India?".

How the Bangaldesh power agreement and the Coal power Plant in India was organised to favour Adani profits... Also the twisting of conditions on privatisation of Airports to a single entity..

SEBI was inquiring into Adani since Jul 2019. Yet it has not found out who the beneficial owner of the mauritius based companies who have invested a major part of the SEBi required 25% of listed company share, are?

Adani Group पर दिए कर्ज को लेकर Bank of Baroda और J&K Bank ने किया बड़ा ऐलान https://www.youtube.com/watch?v=H1LF0q1ZZgU News24 Both Banks say that they have no issues. Repayments are being made and their exposure is as per norms.

Comment on Youttube: Shahid Khan

It is not Adani who has done anything wrong it is our organisation like Sebi and Ed who have note done checks. So that is what is to be looked in. Nexuses should be exposed and further strict law regarding the same should be made.

Kids Learners कोई बात नहीं,सब लोग मिलकर ताली और थाली बजाइए, शेयर ऊपर आ जाएगा। (विश्व गुरु मोदी जी)

rohini kunkal सरकारी बैंक के अधिकारियों को अपनी चिंता है, पब्लिक की नहीं है। धीरे धीरे सभी भारतीय संस्थान अडानी ग्रुप के पक्ष में ऐसा ही बयान देंगे।छ: माह के अंदर सबकी पोल खुल जायगी। किसी भी असामान्य ग्रोथ और डाउनफॉल आम नहीं होती।हर साख में उल्लू बैठा है।

Comment: Are there any norms of total exposure of different banks to corporately entwined groups? While it is true that their exposure may be to what were essentially public goods, for which the public or the sovereign will pay up.. but at what rate? Thus it seems prudent, and perhaps a Adani way out of the mess as suggested by Subramanian Swamy.. to nationalise all those public assets which were recently privatised or allocated .. https://www.youtube.com/watch?v=7MgY5Xqhzn4

https://www.jantakareporter.com/india/modi-govt-is-slowly-disowning-adani-subramanian-swamy-makes-extraordinary-statement-on-financial-scandal-plaguing-pms-billionaire-friend/404451/ “My advice to Modi: Nationalise the entire commercial properties of Adani & Co for “ negative” payment and later auction the properties.”

- Adani Cement Factory strike

- 2013 Gautam Adani: The man who built Rs 47,000 crore infra empire

- What is govt's role in Adani case?

- Organiser article supporting Adani

- Asia's Richest Man Accused of Massive Fraud

- What the rise and fall of Adani stocks says about the Indian state and private capital

- Like ‘Jallianwala Bagh’: How Adani is invoking nationalism to counter allegations of corruption

- With the Adani Crisis, Is Narendra Modi's House of Cards at Risk?

- With Hindenburg, Adani Faces His Stiffest Challenge Yet

- Adani Group stocks crash up to 20% amid Hindenburg report

Subcategories

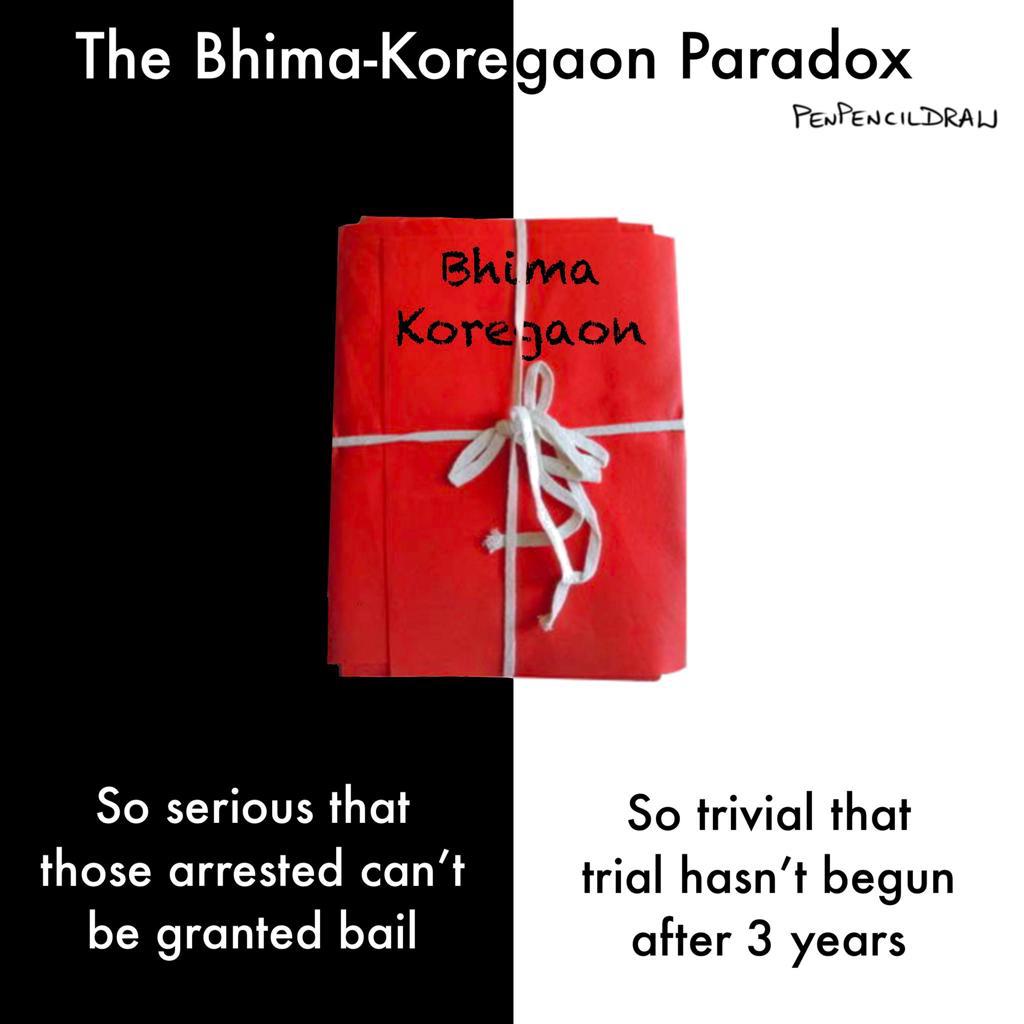

BAIL

For UAPA articles under

Free Speech

Ban on films, documentaries by Government e.g documentary on PM by BBC. Debate on censorship, opinion, statements by media people, leaders, screening of film on Modi at universities etc.

Corporate Behaviour and Free Speech

In a defamation case against Paranjoy Thakurta, a court has order, issued on September 6, directed the removal of defamatory content from their respective articles and social media posts within five days. In the suit filed by Adani Enterprises Ltd, seen by HT, the allegedly defamatory material includes transcripts of YouTube videos, screenshots of X posts by journalists, and images of their X profiles.https://www.msn.com/en-in/news/India/mib-issues-takedown-notices-to-13-digital-news-publishers-over-adani-defamation-case/ar-AA1MIjBR

Based on this, The ministry of information and broadcasting (MIB) on Tuesday issued takedown notices to 13 digital news publishers on YouTube and Instagram for disseminating defamatory content related to Adani Enterprises Ltd.The ministry’s order names journalists, media houses, and creators — including Newslaundry, Ravish Kumar, Dhruv Rathee, The Wire, HW News Network, and Aakash Banerjee’s The Deshbhakt — who have received a list of 138 YouTube video URLs and 83 Instagram links to be taken down.